Welcome to the Billed Right blog, where we’re tackling the nitty-gritty of financial challenges in medical practices. Understanding and navigating the “red zone” is crucial for doctors, practice managers, and medical staff in today’s ever-changing healthcare landscape.

In this article, we’ll explore the three common reasons behind revenue decreases in medical practice. We aim to provide practical insights and strategies to help fortify your practice against financial setbacks. Let’s jump in and unravel the factors that might be impacting your practice’s financial health.

Decreases in revenue for a medical practice can stem from various factors. Here are some common reasons to explore within your medical practice:

Rising Expenses

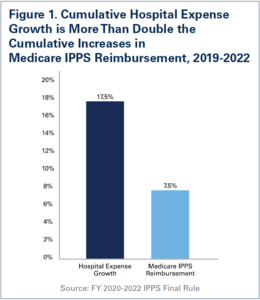

Rising expenses can cast a shadow on the financial health of medical practices, potentially pushing them into the red zone. Identifying the specific cost drivers is crucial, recognizing that these factors can vary based on the specialty of the practice. While not every point may apply universally, it’s essential to pinpoint potential areas of financial strain.

Various factors have contributed to escalating expenses for many practices in recent years. These may include:

- Increases in labor costs

Sources: U.S. Bureau of Economic Analysis (BEA) and U.S. Bureau of Labor Statistics (BLS).

- The rising price of medical supplies and equipment

- The challenge of maintaining and updating technology.

Now, let’s pivot to strategies for trimming costs without compromising patient care. It’s a delicate balance, but there are practical approaches. From negotiating better rates with suppliers to optimizing staff schedules, there are ways to make financial adjustments without sacrificing the quality of care.

Supplier Negotiations:

Approach: Initiate conversations with suppliers to negotiate better rates for medical supplies and equipment.

Staff Optimization:

Approach: Review staff schedules and workload to identify areas for optimization without compromising patient service.

Telemedicine Integration:

Approach: If you have not yet, embrace telemedicine solutions to reduce overhead costs associated with in-person visits.

Electronic Health Record (EHR) Optimization:

Approach: Streamline EHR processes to improve efficiency and reduce time spent on administrative tasks.

Streamlined Billing Processes:

Approach: Identify and address inefficiencies in the billing workflow to reduce errors and speed up reimbursement.

Equipment Maintenance and Upgrades:

Approach: Implement a regular maintenance schedule for medical equipment to extend its lifespan.

Insurance Plan Assessment:

Approach: Regularly review and negotiate contracts with insurance providers to ensure favorable terms.

Engaging in a thorough assessment of these factors within your medical practice can help identify areas for improvement and proactive measures to address revenue decreases.

While we provided some suggestions, it’s important for practices to adapt these strategies to their unique situations, always keeping patient well-being at the forefront. Let’s explore these cost-cutting strategies with a keen eye on maintaining the highest standards of patient care.

Billing Inefficiencies

Imagine a medical practice where billing is a seamless, well-coordinated process. Patient information is accurately captured, billing codes align effortlessly, and the team navigates claims with precision.

The result? Expedited reimbursements, minimal claim denials, and a practice that thrives on the financial front. Streamlined billing processes not only minimize the administrative burden but also contribute to a robust revenue cycle, allowing the focus to remain squarely on providing quality healthcare.

As we dive into billing inefficiencies, envisioning this optimized landscape serves as a reminder of the potential benefits of refining our billing practices.

Regular Staff Training:

Approach: Institute ongoing training programs for your billing team to keep them abreast of the latest coding updates and industry regulations.

Utilize Technology and Automation:

Approach: Invest in advanced billing software that automates routine tasks, reducing the likelihood of errors and streamlining the entire billing process.

Implement Clear Documentation Practices:

Approach: Emphasize the importance of accurate and detailed documentation from healthcare providers.

Conduct Regular Audits and Reviews:

Approach: Periodically review billing records and claims to identify discrepancies and address them promptly.

Stay Informed About Coding Changes:

Approach: Establish a system for staying updated on changes in coding and billing regulations.

Streamline Front-End Processes:

Approach: Ensure that accurate patient information is collected at the front end to minimize errors during the billing process.

Optimize Claims Submission:

Approach: Streamline the claims submission process to reduce the time it takes to process claims.

Address Denials Promptly:

Approach: Establish a protocol for addressing denied claims promptly, with a focus on identifying and rectifying the root cause.

Enhance Communication with Payers:

Approach: Foster open lines of communication with insurance payers to resolve issues and expedite reimbursement.

Insurance Eligibility

Insurance Eligibility Charge Posting

Charge Posting Documentation Review

Documentation Review Claim Submission

Claim Submission Denial Management

Denial Management Payment Posting

Payment Posting Accounts Receivables Follow-up

Accounts Receivables Follow-up Patient Collections

Patient Collections Reporting

Reporting Account Management

Account Management